Frequently Asked Questions

How Do I Stop a Mortgage Foreclosure?

How Do I Stop a Car or Truck Repossession?

My car was repossessed last night - Can I file Bankruptcy to Get it Back?

How Do I Stop a Wage Garnishment Using Bankruptcy?

Do I Have to Live Under a Government budget if I File Chapter 13?

Can Chapter 7 Bankruptcy Get Rid of All My Debts?

What are my alternatives to bankruptcy?

How much will it cost me to file a bankruptcy with Clark & Washington?

Have I waited to late to file?

How fast can you meet with me?

Stopping a Tennessee Mortgage Foreclosure Using Chapter 13

Mortgage foreclosure in Tennessee can be stopped in only two ways. The mortgage lender can voluntarily stop the foreclosure proceeding, or you can file a Chapter 13 bankruptcy.

Generally, you will find that mortgage companies will not voluntarily stop foreclosure proceedings. Under Tennessee law, a mortgage company can start foreclosure proceedings once you are placed into default status because of missed payments. Usually, mortgage companies will wait until you are two or three months behind before they put you into default status and accelerate the mortgage. Acceleration means that the mortgage company has declared the entire payoff balance due and payable.

Because mortgage companies are subject to federal and state banking regulations, changing the status of your account from ŌĆ£delinquent and acceleratedŌĆØ back to ŌĆ£currentŌĆØ is complicated and time consuming. Further, a ŌĆ£delinquent and acceleratedŌĆØ mortgage account will be referred to a foreclosure law firm that has its own case management process. Once the foreclosure process starts, our experience has been that most mortgage companies are not set up to arrange side deals with consumers who promise to cure delinquencies on a case by case basis.

You May Lose Your House to Foreclosure in Tennessee as Fast as 20 Days After Foreclosure Notice is Published

Tennessee allows non-judicial foreclosures, which means that your mortgage company and its foreclosure lawyer do not have to go before a state court judge to obtain permission to take title to your house through a foreclosure. Instead, they need only advertise a notice of the pending foreclosure sale of your property three times in a newspaper published in the county where the foreclosure sale is to be made, with the first publication at least twenty (20) days prior to the sale.

If you are living in the house being foreclosed upon, a notice of the proposed sale must be served upon at least 20 days prior to the proposed sale.

This foreclosure notice serves to give you official notice of your right to redeem the property by paying the entire balance due. This notice also advises you that your property will be sold on the courthouse steps within a few weeks of the date on the foreclosure notice.

Once your account has been referred to a foreclosure law firm, therefore, Chapter 13 bankruptcy remains your most realistic option for saving your home. Chapter 13 will stop any pending foreclosure up until literally the minute before your property is sold on the courthouse steps. It does not matter that the auctioneer may not have actual notice of your Chapter 13 filing. Unless the bankruptcy court has ruled to limit the applicability of the bankruptcy stay in your case, your Chapter 13 filing will invalidate any foreclosure sale.

You can read more about Tennessee foreclosure law by clicking on the link.

Contacting Clark & Washington as soon as you learn of a pending foreclosure remains your best course of action. Although we can handle emergency filings, we can serve you better if we have time to carefully review your intake questionnaire, meet with you and discuss your various options. However, if, for whatever reason, you you have an emergency and a pending foreclosure within the next few days, our firm is uniquely qualified to represent you in this emergency situation.

How to Use Bankruptcy to Stop a Vehicle Repossession or to Recover a Repossessed Car or Truck

If you are facing a threat of repossession from your car or truck finance company, Clark & Washington may be able to help. Even if you are several weeks or months behind and even if a repossession truck is actively searching for your car or truck right now, an emergency Chapter 13 filing can give you necessary breathing room to think about what you want to do and to save your means of transportation.

Under Tennessee law, a car or truck finance company has the right to use ŌĆ£self-helpŌĆØ to enforce its rights if you default on your installment note. The finance companyŌĆÖs right to use self help is subject to some limitations. A repossession agent cannot breach the peace or use violence or force to take your car. This means, for example, that the repossession agent cannot break into your locked garage to grab your car or truck nor can they forcibly remove you from behind the wheel.

If a repossession agent uses force or inappropriate behavior to take possession of your vehicle, he and his client (the finance company) may be liable to your for damages. If you think that you have been a victim of a wrongful repossession, please let us know and we will refer you to a lawyer who specializes in this type of case.

Our firm can help you to prevent a repossession and we can help you if you call us as soon as possible following an actual repossession.

Stopping a Repossession from Happening

Every vehicle finance company has its own policies and procedures with regard to repossession. The installment contract and promissory note you signed when you financed your car or truck contains a provision that discusses default. In most cases, your note goes into default if you miss a required payment. Some contracts give you a five or ten day late payment window to cure the default but technically, as soon as you are one day late, your contract is in default.

If you arranged financing with a large vehicle finance company like GMAC, Ford Motor Credit or Toyota Motor Credit, there is a good chance that your lender will not act aggressively if you fall behind. If at all possible, you should communicate with your lender and try to work out an informal repayment plan.

If this is the first time you have been delinquent and you are financing with a ŌĆ£first tier lender,ŌĆØ you may have as long as two months before the lender decides to schedule your vehicle for repossession.

On the other hand, if your payment history demonstrates a pattern of delinquencies, even a first tier lender will move quickly to seize your car.

If you have financed with a ŌĆ£second chanceŌĆØ lender or with a buy-here-pay-here lender, you should not expect too much leeway. Lenders who work with credit challenged customers generally move to repossess within days of a delinquency.

Regardless of your lender, you should not assume anything from the finance company if you fall behind. We have seen top tier lenders grab vehicles when the customer is only a few days late. Also do not expect to receive any notice of intent to repossess. Because vehicles can be moved or hidden, the law does not require pre-repossession notice.

Because of the credit counseling requirement of the new law, you cannot and should not wait to call us if you see that your loan will be going into default and that you will not have the money to cure the delinquency immediately. Since you may need a day or two to obtain a credit counseling certificate along with pay stubs and other documents needed for filing, the sooner you call us the better.

Getting Your Car or Truck Back Through Bankruptcy After It Has Been Repossessed

Often an actual repossession triggers a call to our office. If your car or truck has already been grabbed by the repossession agent, we can help you, but you must move quickly.

Under Tennessee law, after a vehicle has been repossessed, the law requires your lender to mail you a ŌĆ£ten day letter.ŌĆØ This ten day letter gives you notice of your right to redeem the vehicle by paying off the entire amount of the debt due on the car plus various fees and costs. If you are unable or unwilling to redeem the car within this ten day period, the lender has the right to sell your vehicle at auction.

You can reasonably assume that the auction value of your vehicle will be far less than its retail value. Your lender can then sue you for the difference between the balance due under your installment contract and the auction sale price of the vehicle. In our experience as repossession deficiency claim can amount to $5,000, $10,000 or more.

Because repossessing lenders are usually quick about sending out the ten day letter, you need to move quickly once your vehicle has been repossessed. Our firm has emergency repossession filing specialists on hand who can meet with you immediately, gather the necessary information to file a case and stop the running of the 10 day period. When you file a bankruptcy case, the 10 day auction sale notice period stops and your lender may not take any action to dispose of your vehicle.

Once your case has been filed, our repossession specialists can often convince the lender to return your vehicle without further action. Our attorneys and support staff have established relationships with the law firms who represent most of the vehicle lenders who do business in Tennessee.

You will need to show proof of valid insurance and we must show that your Chapter 13 reorganization plan is feasible.

Sometimes, however, the lender and their counsel will refuse to return your vehicle voluntarily. In such a case, we can file a Complaint for Turnover against the lender and ask your Bankruptcy Judge to order the lender to return the vehicle.

Typically, we can get before your Judge to argue our Complaint for Turnover within about two to three weeks after we file.

Summary: a car or truck repossession in Tennessee can happen to any vehicle owner with a finance contract. Do not assume that you will have a long grace period to make up missed payments and seek legal counsel as soon as you recognize that your vehicle is at risk. You can avoid a transportation disruption by seeking our counsel prior to a repossession but if your car or truck is repossessed, we usually can get it back if you contact us as soon as you can after the repossession. We will not be able to get your vehicle back if you cannot provide proof of insurance to the lender.

Can I Use Bankruptcy To Get Back My Recently Repossessed Vehicle?

As your attorneys, we are people too. Your frustrations and anger become our concerns when we accept you as our client. Nothing gives us more motivation to fight for our clients than news of a vehicle repossession. In todayŌĆÖs economy, transportation is necessary if you want to find and keep a good job in the Chattanooga area. Many of our clients travel many miles - sometimes even crossing state lines - to get to work. This is why a vehicle repossession can be so devastating.

You may already know that the filing of a bankruptcy will stop a repossession from happening - but did you know that we can help even if the repossession has already happened?

DonŌĆÖt Delay Taking Action When Your Vehicle is Repossessed

Here is some good news - if your car or truck was repossessed within the last week or two there is a very good chance that we can use the power of the bankruptcy court to get your vehicle back.

Clark & Washington uses the strategy of a Chapter 13 bankruptcy combined with a special lawsuit filed in Bankruptcy Court called a Complaint for Turnover to recover your vehicle. Since your Chapter 13 serves as a payment plan, you must have a way to earn money to pay you household bills as well as your Chapter 13 plan. If you have no way to get to work because your car or truck has been seized, you obviously cannot perform your obligations under Chapter 13. Our goal, therefore, is to convince the judge that your vehicle is essential to the successful functioning of your chapter 13 plan.

How Long Will It Take To Get My Vehicle Back?

In many cases, we will be able to get your vehicle back within a matter of days after you Chapter 13 case has been filed. Our attorneys have established positive relationships with many of the lawyers represent vehicle finance companies, and we can often negotiate a return of your vehicle on a voluntary basis. If you have filed bankruptcy before, however, or if we are dealing with a ŌĆ£buy here pay hereŌĆØ vehicle lender, we may actually have to take your case before the judge.

If we have to go to court, we may not be able to get in front of a judge for two to three weeks. Bankruptcy court calendars are crowded and the law says that we have to give the lender and its representative sufficient notice. You can help speed up the process by providing us with a copy of your car insurance declarations page and by fulfilling your financial obligations under your Chapter 13 plan while we wait for a court date.

We also find that the identity of the lender can make a difference. Large finance companies who frequently deal with bankruptcy issues often have set policies for returning vehicles once a Chapter 13 is filed. By contrast, however, smaller lenders and ŌĆ£buy here/pay hereŌĆØ finance companies tend to be less cooperative.

Will I be Responsible for Repossession Costs and Storage Fees?

As you might imagine, vehicle finance companies will try to get you to pay repossession costs and storage fees. If you have the money, and the amount at issue is $100 or $200, we may decide that it makes sense to pay these fees in exchange for getting your vehicle back quickly, and avoiding the risk of going to court. However, if the lender is demanding $500 or $600 of fees and costs, it probably makes sense to take our chances in court.

Often we can negotiate with a lender to include repossession costs and storage fees as part of the lenderŌĆÖs proof of claim. This means that the cost of repossession be paid as part of your chapter 13 plan. every case is different, and we will do our best to advise you about the most appropriate strategy in your particular circumstances.

What Can I Do About Damage to My Vehicle or Missing Personal Possessions After I Get My Car Back?

If you notice significant damage to your vehicle that was caused by the repossession company, or if your personal possessions are missing from your car, we do have the right to go back before the bankruptcy judge to ask for damages. As you might imagine, however, you will need to have proof of these damages in the form of pictures, receipts, and witness testimony.

You should contact us as soon as possible after you notice that thereŌĆÖs a problem so that we can make every effort to resolve this issue.

What Can I Do if My Truck Was Repossessed Three Months Ago - Is it Too Late?

If your vehicle was picked up to three months ago, and you did not respond to any ŌĆ£10 day letterŌĆØ thereŌĆÖs a good chance that your vehicle has been sold at an auto auction. Tennessee law requires lenders to provide vehicle owners with a short, 10 day, period of redemption following repossession. Assuming that the lender follows the procedures set out for notice under Tennessee law, then title to your vehicle passes to a new owner at the time of the auction sale.

Occasionally, a lender fails to exercise its rights in a timely manner and we still may be able to recover your vehicle even if several weeks or months have passed since repossession. Time is definitely of the essence would come straight possessions so we urge you to contact us sooner rather than later if your vehicle has been repossessed.

Nothing good happens after a repossession. If you do not take quick action, you will lose your vehicle, and it is likely that the lender will eventually sue you for a repossession deficiency. Call Clark & Washington immediately to preserve your options if you have experienced a repossession.

Stop Wage Garnishment, Protect Your Employment and Avoid a Budget Disaster

If you are facing a wage garnishment, Clark & Washington can help you. When we file your Chapter 13 or Chapter 7 bankruptcy petition, any pending garnishment (except for child support) will stop immediately. Any funds seized after the date of your bankruptcy filing will be returned to you.

State Court Judgments Can Result in Significant Seizure of Your Income

In most cases, wage garnishments arise from lawsuit judgments. Judgments come from lawsuits. For example, if a credit card company filed suit against you for non-payment and you did not answer, a default judgment would issue against you. If you were involved in litigation and lost, a judgment would issue against you.

Our clients sometimes report that they were not even aware of a pending lawsuit, much less a judgment. This type of unpleasant surprise happens more often than you might think. SheriffŌĆÖs deputies, who are responsible for serving the lawsuit, are permitted to leave the lawsuit with an adult who answers the door to your house. We sometimes see cases where a spouse accepts service but fails to deliver the lawsuit papers to the named defendant.

In other cases, often involving credit card debt, the cardholder agreement provides that payment disputes shall be referred to an arbitrator out of State, or that a specific court in another State shall be the venue for any collection lawsuit. These venue provisions effectively mean that you have waived your right to defend a collection lawsuit in your county. Some legal commentators argue that this type of venue shifting is unconstitutional or illegal, but unless you have the funds to mount a ŌĆ£collateral attackŌĆØ against the judgment, you will be stuck with it.

If your creditor possesses an out of State judgment, it can ŌĆ£domesticateŌĆØ the judgment in your home county. Once a judgment is domesticated here, you will be subject to wage garnishment, bank account levy and any other remedies otherwise available to a winning plaintiff here in Tennessee.

Wage Ganishment Threatens 25% of Your Net Pay and Possibly Your Job

Once a judgment has been issued, your creditor can ask the local sheriffŌĆÖs office for a ŌĆ£fi faŌĆØ and a summons for continuing garnishment. Your employer will be served with this garnishment summons and ordered to withhold 25% of your after tax earnings. In addition, your employer may charge a handling fee for the extra paperwork involved with fulfilling the garnishment requirements.

Be aware that your employer cannot choose to ignore a summons of continuing garnishment. If your employer does not honor the summons, your employer will become responsible for payment of the entire debt.

As you might imagine, human resource and payroll coordinators for most employers find wage garnishments troublesome for a number of reasons. Firstly, your employer must expend time and effort to complete the paperwork associated with calculating and processing garnishment orders. Secondly, until the garnishment is paid in full or otherwise released, your employer has potential financial liability if there are errors with the paperwork. Finally, your credibility may be called into question as a defendant found liable for a judgment in a lawsuit. It would not be an understatement to conclude that your job might be at risk if you involve your employer in your personal business and wage garnishment.

Clark & Washington can stop any pending garnishment no matter where you fall in the process. If you contact us before the pending lawsuit against you goes into default, we may be able to avoid a judgment from issuing. If a judgment has been issued, the judgment creditorŌĆÖs right to seize your wages terminates the instant we file your bankruptcy case. Sometimes, money that has been seized can be returned to you or it can be used to pay non-dischargeable debt like taxes.

Special Bankruptcy Motion to Avoid Lien Protects Your Income in the Future

Because an outstanding judgment can continue to affect you negatively, we also use the power of the Bankruptcy Court to eliminate the judgment lien altogether. In many cases, we can file a Motion to Avoid the Judicial Lien, which results in a cancellation of the filed judgment against you. An order avoiding the judgment actually changes your creditorŌĆÖs status - the judgment will be canceled and your judgment creditor will have no more rights than any other discharged unsecured creditor. After your bankruptcy ends, your judgment creditors will be discharged and lose any right to come after you again.

Summary: Judgments and wage garnishments function as powerful tools used by creditors to seize your money. When we file your bankruptcy case, your creditors are powerless to take any action and they lose their right to seize your wages. You can file a bankruptcy at any point in the pre-judgment or judgment process to put an end to creditor action. DonŌĆÖt wait until your wages are at risk - call Clark & Washington as soon as you suspect any risk of wage garnishment.

Am I Required to Live Under a Government Created Budget if I File Chapter 13

One of the most confusing and misunderstood components of the bankruptcy law has to do with the budget you submit to the bankruptcy court. When you file a Chapter 13 case, you must submit a budget that is ŌĆ£reasonable.ŌĆØ Our job, as your attorneys, is to work with you to create a workable budget that you can live with and that will be found acceptable by the Chapter 13 trustee and the bankruptcy judge.

The Bankruptcy Court Does Not Create a Budget for You

The bankruptcy court does not create a budget for you, nor will any judge require you to sell your house, give up your car or change your job. At worst, the approval (confirmation) of your case will be denied and you will end up just as you were prior to filing. As your attorneys, we will spend a great deal of time with you discussing your budget, and preparing the budget schedules that will be filed in your Chapter 13 case. You can expect your chapter 13 trustee to look at your schedules of income and expenses and to object if the trustee believes that you are spending money unnecessarily.

If the chapter 13 trustee and/or your creditors object to your monthly spending habits, they are permitted to file an objection to the confirmation of your chapter 13 plan. Usually, we can negotiate a compromise by adjusting your budget and reducing some of your monthly expenditures.

The bankruptcy court does look at the budget categories created by the IRS for use in tax repayment plans. Despite what you may have been told, you are not required to adopt the IRS budget. Instead, the IRS numbers are used as part of a ŌĆ£means testŌĆØ analysis to determine whether you qualify for Chapter 7 or Chapter 13. Assuming that the means test analysis shows that you have to file a Chapter 13, the ŌĆ£reasonablenessŌĆØ standard applies.

Chapter 13 Budgets Must be Reasonable

As you might imagine, however, you cannot include luxuries or extravagances in a Chapter 13 budget. Issues that sometimes come up include private school tuition, timeshare and expenses, boat ownership and maintenance, support of a sibling or parent, and repayments of 401(k) loans. Our job as your journeys is to spot potential problems and to advise you of the best way to proceed. Creating a budget in a Chapter 13 is more of an art than a science, and we cannot always predict which budget entries will generate an objection.

If budget objections are filed, you can rest assured that your Clark and Washington lawyer will represent your interests zealously and we will fight for approval of a budget that is livable and reasonable in your Chapter 13 case.

A Fresh Start With Chapter 7 Bankruptcy

Chapter 7 bankruptcy serves as the most powerful debt control tool available to ordinary citizens. While you should not look to file bankruptcy unless absolutely necessary, Chapter 7 can provide you with a fresh start to your financial life. You can literally walk away from credit card bills, medical expenses, repossession deficiencies, old apartment leases and personal loans. You can use Chapter 7 to cancel lease contracts, and to surrender that too-expensive car or house.

Chapter 7 bankruptcy exists because Congress recognizes that honest, hardworking people sometimes get into serious financial trouble. Despite what an aggressive bill collector may tell you, Chapter 7 is legal, it is ethical, and it functions as a powerful financial tool that you can use.

Are You Stuck in a ŌĆ£Cycle of Debt?ŌĆØ

You may be familiar with the term ŌĆ£cycle of debt.ŌĆØ A debt cycle arises when you incur debt with the hope and expectation to repay your obligations, but later discover that you simply cannot afford both your regular household expenses and your monthly debt service. Minimum monthly payments on consumer debt rarely reduces the principal - you typically pay only interest.

Eventually a missed or late payment or a loss of income due to a family emergency leads to penalties, interest at twenty percent or higher and aggressive collection action against you. Typically, when you fall behind with one creditor, news of your delinquency appears on your credit report and many of your other creditors will immediately increase your interest rate because of the change in your risk profile.

If you are trying to support your family on a modest income, a debt cycle crisis can lead to marital problems, school problems and can threaten your ability to provide food and shelter for your family. Congress saw the need to make some form of relief available to you if you are caught in a debt cycle.

Learn About Your Options - Both Bankruptcy and Non-Bankruptcy

Clark & Washington bankruptcy lawyers can counsel you about your bankruptcy options. Perhaps because it is such a powerful tool, Congress has tightened the qualification rules for filing Chapter 7 bankruptcy, and our firm has filed hundreds of Chapter 7 cases in Chattanooga and in other Tennessee cities. Let there be no mistake - Chapter 7 relief still exists and for most people surviving on an modest income, you will most likely qualify. And if Chapter 7 does not make sense for you, we can discuss a Chapter 13 bill consolidation plan as well as non-bankruptcy alternatives.

Chapter 7 bankruptcy may be the tool that empowers you to break your own cycle of debt. If you are struggling to pay your bills, call us at 423-634-1910 for a free telephone or office consultation. Bankruptcy is not always the right answer but you will not know if you do not call.

What Are My Alternatives to Bankruptcy?

Before filing bankruptcy a bankruptcy case, you should consider available alternatives to actually filing. Your first step should be to request credit reports from Equifax, Experian and TransUnion. These companies are the countries three largest credit bureaus and one or more of them will have you on file. Credit reports will identify your creditors and the amounts owed. Sometimes, when you discover exactly what you owe, your total debt situation may not seem so terrible.

Can I make Informal Payment Plans With My Creditors?

Once you know what you owe, you may want to create your own payment plan whereby you set up payment plans with one or more of your creditors. You will find that you can strike a better deal if you have cash. If your creditors agree to a payment plan, you should confirm your understanding in writing. As part of your negotiations, try to convince the creditors to delete unfavorable marks on your credit reports. If you are able to work out a payment plan, do your best to stick to it.

Creditors may want you to sign "consent judgments" or other legal papers spelling out the terms of your agreement to pay. Clark & Washington recommends that you avoid signing any contract or consent judgments with creditors without first speaking with an attorney since the paperwork you sign could contain admissions of certain facts or could waive rights.

What about Consumer Credit Counseling?

Another popular alternative to bankruptcy is Consumer Credit Counseling, a nonprofit organization financed by MasterCard and Visa. If your debt is not too overwhelming and you have decent income, CCCS may be able to create a payment plan that allows you to pay back your debts over time. CCCS has been approved as a credit counseling organization that offers pre-bankruptcy credit counseling to potential bankruptcy filers.

While CCCS is an excellent organization, they usually cannot help if you are behind on your car or house payment. They also may not be able to help if you owe credit card companies not affiliated with MasterCard or Visa. CCCS was created by credit card companies for the purpose of helping you in paying back all of your credit card debt. CCCS counselors are not attorneys and they are not required to discuss with you bankruptcy or other options.

What About Private Debt Counseling Companies?

There are other "credit counseling services" you may see in the phone book, advertised on a telephone pole or advertised through unsolicited mail. Some of these services offer to clear your credit file or to get you a new credit file. Often private credit counseling companies demand a large up front retainer and they promise more than they can deliver. Recently several of these companies have been in the news when they have been sued by a State Attorney General for consumer fraud. Usually, these organizations are rip-offs and you should avoid them.

Do not be taken in by the term ŌĆ£non-profitŌĆØ as meaning that the credit counseling company is performing a public service. Frequently a private debt counseling agency will operate as a ŌĆ£non-profitŌĆØ while the owners profit handsomely through the ŌĆ£managementŌĆØ company that contracts to operate the non-profit. If you are considering using a private debt management company, be sure to check out its reputation with the Better Business Bureau and the Tennessee State Department of Consumer Affairs.

Finally, you should realize that it will take a great deal of both discipline and money to pay off substantial credit card debt. For example, if you have $10,000 in credit card debt and you want to pay it off in two years, you will need to pay $520 per month; in three years, you will need $382 per month. If you wanted to pay off the $10,000 at $200 per month, it would take you over ten years. Credit card debt is especially stubborn to eliminate because of the high (18% to 20%) interest that keeps adding up.

Will Budget Reduction Plans Solve My Debt Problems

A visit to your local bookstore will reveal a number of well written guidebooks that offer help to debt burdened individuals. If your debt is not totally out of control, and if you have the discipline to modify your lifestyle (i.e. using public transportation instead of a private car), and if you are not facing lawsuit threats, then some of these programs can work.

The practical problem with budget based debt reduction plans has to do with time (your creditors will not hold off indefinitely) and lifestyle (are you really willing to significantly change how you live).

There is certainly no harm in trying a budget based debt reduction plan and if you do end up filing the changes in your budget will most likely be bankruptcy friendly.

How Much Will It Cost For Me to File Bankruptcy?

Clark & Washington makes every effort to keep your bankruptcy filing costs down. In most cases, we can file your petition for the filing fee only.

Chapter 13 - Unlike many of our competitors, Clark and Washington does not charge any up front attorneyŌĆÖs fee. In most cases, 100% of our fee is paid through your Chapter 13 plan by the Chapter 13 trustee. Your up-front cost for Chapter 13 is only $310, which is the Court filing fee.

Chapter 7 - Unlike many other bankruptcy firms, Clark & Washington asks for the filing fee of $335 only to start your Chapter 7 case. You can pay the attorneyŌĆÖs fee in monthly installments of $250 per month over several months. In most cases, the attorneyŌĆÖs fee for Chapter 7 will be around $1,000.

At Clark & Washington, our philosophy has always been that the issue of attorneyŌĆÖs fees should never stand between you and the bankruptcy relief you need.

Have I Waited Too Late To File My Bankruptcy?

Because Clark & Washington is well known for bankruptcy representation in the Chattanooga metro area, we often get emergency calls from potential clients who need immediate action. The days before a foreclosure always busy. Similarly, we frequently hear from anxious people who are literally driving around to avoid the repo agent, or from employees who have only a few hours to stop a wage garnishment.

If you are facing one of these emergency situations, please relax - we can and will help you. Because bankruptcy is our only area of practice, we have lawyers on duty late into the evening and on weekends, and we can schedule an emergency appointment for you immediately.

Remember, however, that before we can file a case for you, you will need to obtain your certificate of credit counseling.

Electronic Filing = Immediate Protection

As an authorized user of the Bankruptcy CourtŌĆÖs electronic filing system, our firm can file over a secure Internet connection with the Clerk of Court. Once your case is filed, we will generate an official proof of filing that you can show to any aggressive creditor, repossession agent or even to a state court judge.

Further, once we file your case, one of our paralegals will telephone or fax any lawyer, creditor or collection agent who is threatening immediate action. We have contact information for most of the collection agencies and collection lawyers in the country and we will act fast to serve you.

You can ignore the misinformation spread by many collection agents and repossession agents. The minute we file your case, you are protected. It does not matter that the creditor has not received any official notice - except in limited cases, once we have a case number, you are automatically protected.

Do note that if this is your second or third active bankruptcy case pending within the previous year or if your last case was dismissed ŌĆ£with prejudiceŌĆØ different rules apply. Make sure to advise your Clark & Washington lawyer about any prior bankruptcy filings.

Clark & Washington welcomes the difficult bankruptcy cases that other firms turn away. We are prepared to act quickly and forcefully to protect your rights.

How Fast Can You Meet With Me to File for Bankruptcy?

Financial crises sometimes occur when you least expect them. You may learn of a threatened repossession or wage garnishment at 5pm on a Friday, or a deal to stop a mortgage foreclosure may fall through on the Monday prior to a Tuesday foreclosure. Clark & Washington will be there for you at these times of need. Our offices are open late and we can schedule a weekend appointment. Call us any time at 423-634-1910 and one of our attorneys will get back with you within a few minutes.

Emergency Bankruptcy Relief to Head Off Crisis

If you have an emergency situation and need to meet with an experienced bankruptcy lawyer, we will schedule an appointment for you immediately. Our firm prides itself on our willingness to take the last minute cases that other law firms refuse to handle.

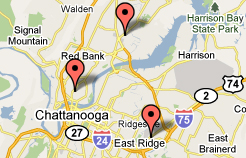

Further, Clark & Washington attorneys can meet you near where you live. We have 3 satellite offices the Chattanooga area, including our main office on Lee Highway, and satellite offices in Hixson and Cleveland. Click here to view a map showing our Chattanooga area locations.

DonŌĆÖt Forget About Mandatory Credit Briefing Certificate

One word of warning - the new bankruptcy law requires you to obtain a credit briefing before you will be allowed to file your case. Credit briefings can be done over the phone or Internet in as little as 45 minutes. As soon as you see that bankruptcy may be an option for you, we strongly recommend that you schedule your credit briefing at your earliest convenience.